CPA (Cost Per Acquisition) and CAC (Customer Acquisition Cost) are both essential marketing metrics, but they measure different things. CPA focuses on the cost of a specific action, like a signup, form submission, or purchase, while CAC measures the total cost of acquiring a paying customer. Essentially, CPA is a more granular, campaign-level metric, while CAC provides a broader, more holistic view of the overall cost of acquiring a customer.

This guide will break down the difference between CAC and CPA, show how to calculate each one, explain why they both matter, and give you practical strategies to reduce your customer acquisition costs while keeping your growth sustainable.

What Is Customer Acquisition Cost and How Do You Calculate It?

Customer Acquisition Cost, or CAC, is the total amount of money your business spends to acquire a new paying customer. It includes everything—paid ads, sales team salaries, software tools, content creation, agency fees, and any other expense tied to bringing in customers.

It’s a crucial metric because it tells you how much you’re investing to grow your customer base. If your CAC is too high compared to the revenue a customer brings over time, your business won’t be sustainable.

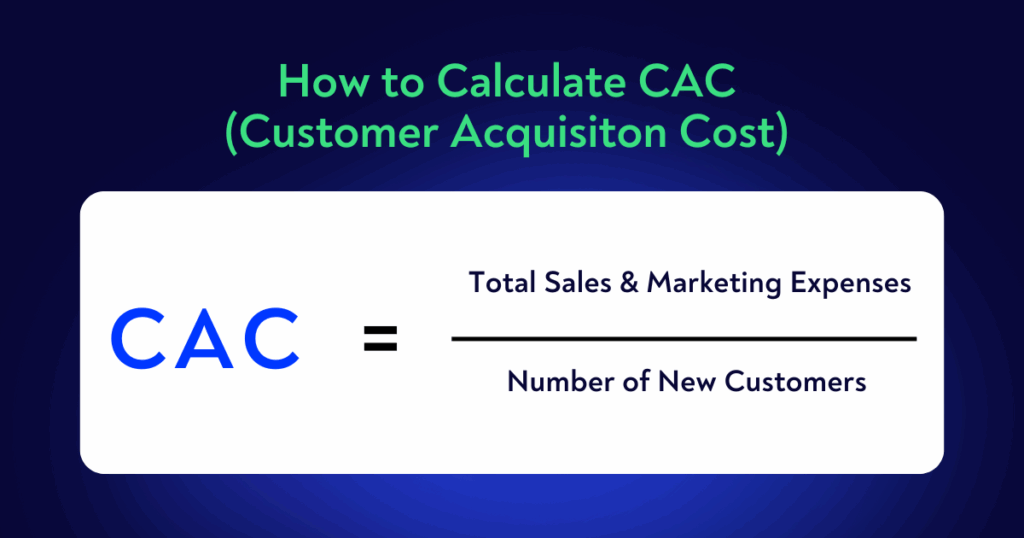

The formula to calculate CAC is simple:

CAC = Total Sales & Marketing Expenses ÷ Number of New Customers

Let’s put that into context with a few examples:

If you run a SaaS company, your sales and marketing costs might include paid ads, CRM tools, salaries, onboarding materials, and webinars. If you spend $50,000 in one month and bring in 500 new customers, your CAC is $100. In this case: $50,000 ÷ 500 = $100

In e-commerce, you’re looking at ad spend, influencer collaborations, email marketing tools, and maybe free shipping promotions. Spend $25,000 in a month and get 200 customers? Your CAC is $125.

For a service-based business, like a marketing agency, costs could include client acquisition calls, proposal creation time, networking event fees, and online ads. If it costs $30,000 to land 50 new clients, your CAC would be $600.

In short, CAC tells you how efficient (or expensive) it is to win customers. Keeping an eye on this number helps you control profitability and scale wisely.

What Is a Good Customer Acquisition Cost?

Figuring out whether your CAC is “good” isn’t a one-size-fits-all matter. It depends largely on your industry, business model, and profit margins. The key to understanding this is comparing CAC to your customer lifetime value (LTV).

Ideally, your LTV:CAC ratio should be 3:1—that is, for every dollar you spend acquiring a customer, you earn three back over their lifetime. A 4:1 ratio suggests you’re too cautious with acquisition and may be missing growth opportunities, while anything lower than 3:1 can signal overspending.

This ratio isn’t arbitrary—it’s a mark of sustainable and scalable growth. In SaaS, for example, this benchmark is standard; some early-stage startups may start with a lower ratio (around 2:1), but aiming for 3:1 is crucial as the business grows.

At the same time, you’ll want to tailor CAC goals based on your margins and customer journey. E-commerce brands often aim for CAC to be one-third or one-fourth of LTV, meaning a 3:1 or even 4:1 ratio works well there too. High-margin businesses or B2B companies with longer sales cycles may sustain higher CACs, as these factors allow more flexibility.

What Is an Average CAC in Retail?

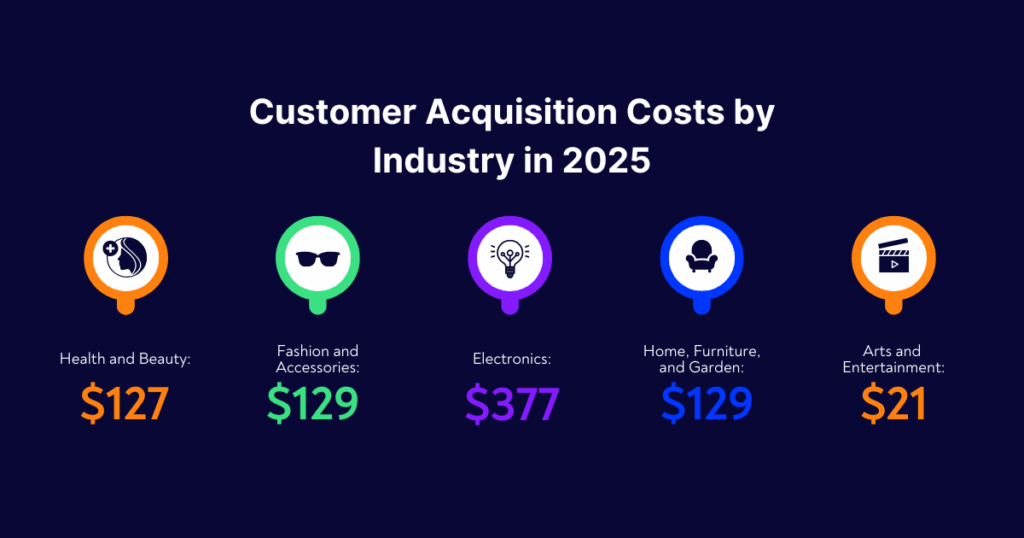

Customer Acquisition Cost varies significantly across different retail sectors. According to Shopify’s 2025 data, the average CAC for various retail industries is as follows:

- Arts and Entertainment: $21

- Health and Beauty: $127

- Fashion and Accessories: $129

- Home, Furniture, and Garden: $129

- Electronics: $377

These figures highlight how CAC can differ based on industry characteristics. For instance, sectors like arts and entertainment often benefit from organic reach and shareable content, leading to lower acquisition costs. In contrast, industries such as electronics may require more substantial investments in advertising and promotions due to higher competition and longer decision-making processes.

Retail businesses generally experience lower CAC compared to sectors like B2B services or financial services. For example, B2B SaaS companies often face higher CAC due to longer sales cycles and the need for personalized outreach. Conversely, industries with impulse-buy products or lower-priced items may achieve higher conversion rates, potentially reducing CAC.

Factors Influencing CAC

Several elements can impact CAC within the retail sector:

- Marketing channels: Using platforms like social media, search engine advertising, and influencer partnerships can affect CAC.

- Average Order Value (AOV): A higher AOV can justify a higher CAC, as the return on investment per customer is greater.

- Customer Lifetime Value (LTV): A higher LTV allows businesses to spend more on acquiring customers while maintaining profitability.

- Brand recognition: Established brands may experience lower CAC due to existing customer trust and loyalty.

What Is Cost Per Acquisition (CPA) and How Do You Calculate It?

If you’re wondering “What is CPA in marketing?”, here’s your direct answer: Cost Per Acquisition, or CPA, is a key digital marketing metric that measures how much it costs to drive a specific action, usually a lead, signup, sale, or other conversion. A lower CPA means you’re getting more conversions for less money, which directly improves your ROAS (Return on Ad Spend).

It’s one of the most common metrics advertisers use to understand how efficient a campaign is at driving results. Marketers use CPA to compare the efficiency of different campaigns and channels, optimize ad creatives, targeting, and bidding strategies, and decide whether to scale a campaign or pause it if it’s underperforming.

While CAC looks at the overall cost of getting a paying customer, CPA focuses on the cost of getting someone to complete a particular action within a single campaign. This could be downloading an app, filling out a form, or making a purchase.

How to Calculate CPA

If you’re wondering how to calculate CPA, the formula is simple:

CPA = Total Campaign Cost ÷ Number of Conversions

If you spent $2,000 on a Google Ads campaign that generated 80 conversions (for example, signups), your CPA would be: $2,000 ÷ 80 = $25 per acquisition.

Let’s see other examples:

- Google Ads: You run a search campaign promoting a product. You spend $1,500 and get 60 purchases. Your CPA is $25.

- Meta Ads: You run a lead generation campaign for a webinar. You spend $500 and get 100 signups. Your CPA is $5 per signup.

- Influencer marketing: You pay an influencer $1,000 for a sponsored post. That post drives 50 new app downloads. Your CPA is $20 per download.

CAC vs CPA: Key Differences and Examples

It’s common for people to confuse CAC and CPA, after all, both are acquisition-related costs. But what is the difference between CAC and CPA? In reality, they serve very different purposes in marketing analysis.

Let’s make it simple:

- CPA tells you how much you’re paying for a single conversion—whether that’s a signup, download, form fill, or purchase—within a specific campaign.

- CAC shows the total cost of turning someone into a paying customer, factoring in everything from marketing to sales, onboarding, and operational costs.

Imagine you’re running a Google Ads campaign for a SaaS product.

- You spend $2,500 on ads and get 100 signups. Your CPA = $25 per signup.

- But only 25 of those signups become paying customers.

- On top of the ad spend, you’ve also spent $2,500 on salaries for your sales and customer success teams, plus CRM software and onboarding tools.

- Your total cost is $5,000, and you gained 25 customers, so your CAC = $200 per customer.

This example shows exactly how CPA and CAC serve different layers of decision-making. CPA helps marketers optimize campaigns, while CAC gives the business a reality check on whether their acquisition efforts are actually profitable and sustainable.

CAC vs CPA: Main Differences

| Feature | Cost per Acquisition (CPA) | Customer Acquisition Cost (CAC) |

|---|---|---|

| Focus | Specific actions (leads, signups, sales) | Paying customers |

| Scope | Campaign or channel level | Entire acquisition strategy |

| Timeframe | Short-term (campaign-based) | Long-term (full customer journey) |

| Metric Type | Cost per action | Total cost to acquire a customer |

| Optimization | Campaign performance | Business model efficiency and sustainable growth |

Why Do CPA & CAC Metrics Matter?

CPA focuses on the short game. It’s all about campaign optimization. Marketers use it to figure out whether an ad is generating signups, downloads, or purchases at a reasonable cost. If the CPA is too high, it’s a sign that something’s off with your targeting, messaging, or offer.

On the other hand, CAC plays the long game. It looks beyond individual campaigns and considers the total cost of acquiring a paying customer, including overhead, salaries, tools, and other operational expenses. CAC helps with budget planning, forecasting, and evaluating whether your overall customer acquisition approach is sustainable.

Why You Need Both

If you focus only on CPA, you risk thinking a campaign is successful just because it’s bringing in leads, without realizing those leads never actually convert into paying customers.

If you focus only on CAC, you miss opportunities to refine campaigns in real time and might let inefficient ad spend continue for too long.

Tips to Reduce Customer Acquisition Costs

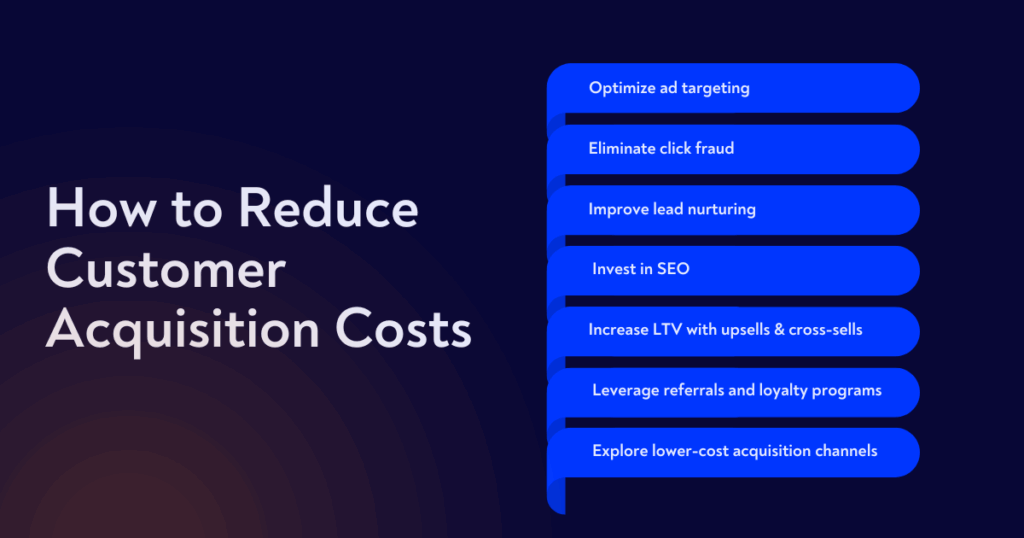

Lowering your CAC isn’t just about cutting costs—it’s about becoming more efficient at turning prospects into customers. Here are some proven ways to make that happen:

- Optimize ad targeting: The more accurate your targeting, the less money you waste on the wrong audience. Use tools like lookalike audiences, demographic filters, and behavioral data to focus on people most likely to convert.

- Eliminate click fraud: Fake clicks quietly drain your budget. Click fraud protection tools like ClickGUARD block invalid traffic from bots, competitors, or malicious actors, keeping your ads focused on real prospects.

- Improve lead nurturing: Bringing leads in is just the start. Strong email sequences, retargeting campaigns, and personalized offers help convert those leads into paying customers, lowering your CAC by making the most of every click.

- Invest in SEO: Organic traffic is the gift that keeps on giving. Investing in SEO reduces your reliance on paid ads over time, which means fewer acquisition costs and more sustainable growth.

- Increase LTV with upsells & cross-sells: When customers buy more from you, you can afford a higher CAC while still growing profitably. Focus on complementary offers, upgrades, and packages that add value.

- Leverage referrals and loyalty programs: Happy customers are your best marketers. Referral programs encourage them to bring in new customers, and loyalty programs help retain them, both contributing to lower acquisition costs over time.

- Explore lower-cost acquisition channels: Don’t rely only on pay-per-click advertising. Test influencer marketing, partnerships, affiliate programs, and content marketing. These channels often have lower upfront costs and can bring in highly qualified customers.

Optimize Your Customer Acquisition Cost With ClickGUARD

Cutting customer acquisition costs starts with making sure every dollar you spend is actually working toward real growth and not wasted on fake clicks or invalid traffic. That’s where ClickGUARD comes in.

ClickGUARD helps advertisers protect their paid campaigns from click fraud, bots, and malicious traffic that quietly drains budgets. By blocking invalid clicks in real time, you not only protect your ad budget but also improve the quality of traffic hitting your site, which directly impacts your CPA and CAC.

When you’re not wasting money on fake clicks, your campaigns become more efficient. You get better data, better leads, and ultimately, better customers. That means a lower customer acquisition cost and a healthier ROI.

With ClickGUARD, you can:

- Detect and block fraudulent clicks automatically.

- Protect Google Ads, Microsoft Ads, and Meta campaigns.

- Optimize campaigns for real human traffic.

- Cut acquisition waste and improve ad efficiency at scale.

If lowering your CAC is part of your growth plan, ClickGUARD is essential!

Is a CPA the same as a CAC?

No, CPA and CAC are not the same. CPA (Cost Per Acquisition) measures how much you spend to get a specific action, like a signup or form submission. CAC (Customer Acquisition Cost) is broader—it includes everything you spend to acquire a paying customer, from marketing and sales to software and salaries.

What’s the difference between CPS and CAC?

CPS (Cost Per Sale) tracks how much you pay to drive a single sale, often tied directly to ad spend. CAC looks beyond that, combining all costs involved in turning a lead into a paying, long-term customer.

Are CPA and CAC interchangeable metrics?

CPA and CAC are not interchangeable metrics. CPA is campaign-level and short-term—it tells you how efficiently an ad campaign is driving actions. CAC is a big-picture, business-level metric that helps you understand if your overall growth strategy is sustainable and profitable.

Is CPA a KPI?

Yes, CPA is one of the most important KPIs in digital marketing. It’s a key metric for measuring how effective and efficient your campaigns are at driving conversions.

What’s a good LTV-to-CAC ratio?

A healthy LTV-to-CAC ratio is typically 3:1. That means for every $1 you spend to acquire a customer, that customer should generate at least $3 in revenue over their lifetime.